Direct bank

payments,

no cards needed

Direct bank

payments,

no cards needed

Customers pay straight from their bank account using Open Banking. Money moves fast, securely and costs less than card payments.

Customers pay straight from their bank account using Open Banking. Money moves fast, securely and costs less than card payments.

Customers pay straight from their bank account using Open Banking. Money moves fast, securely and costs less than card payments.

How to Get Started

How to Get Started

How to Get Started

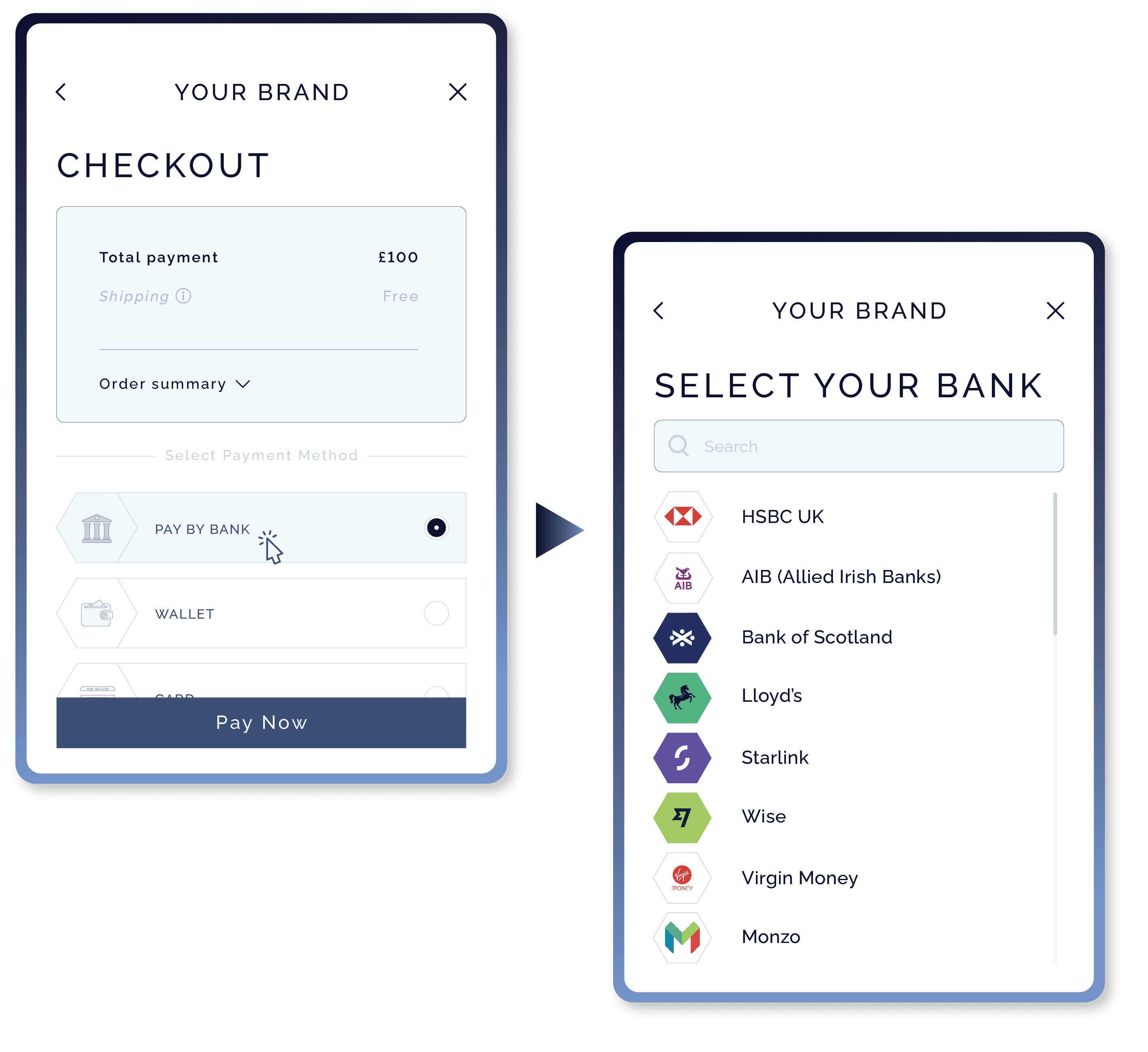

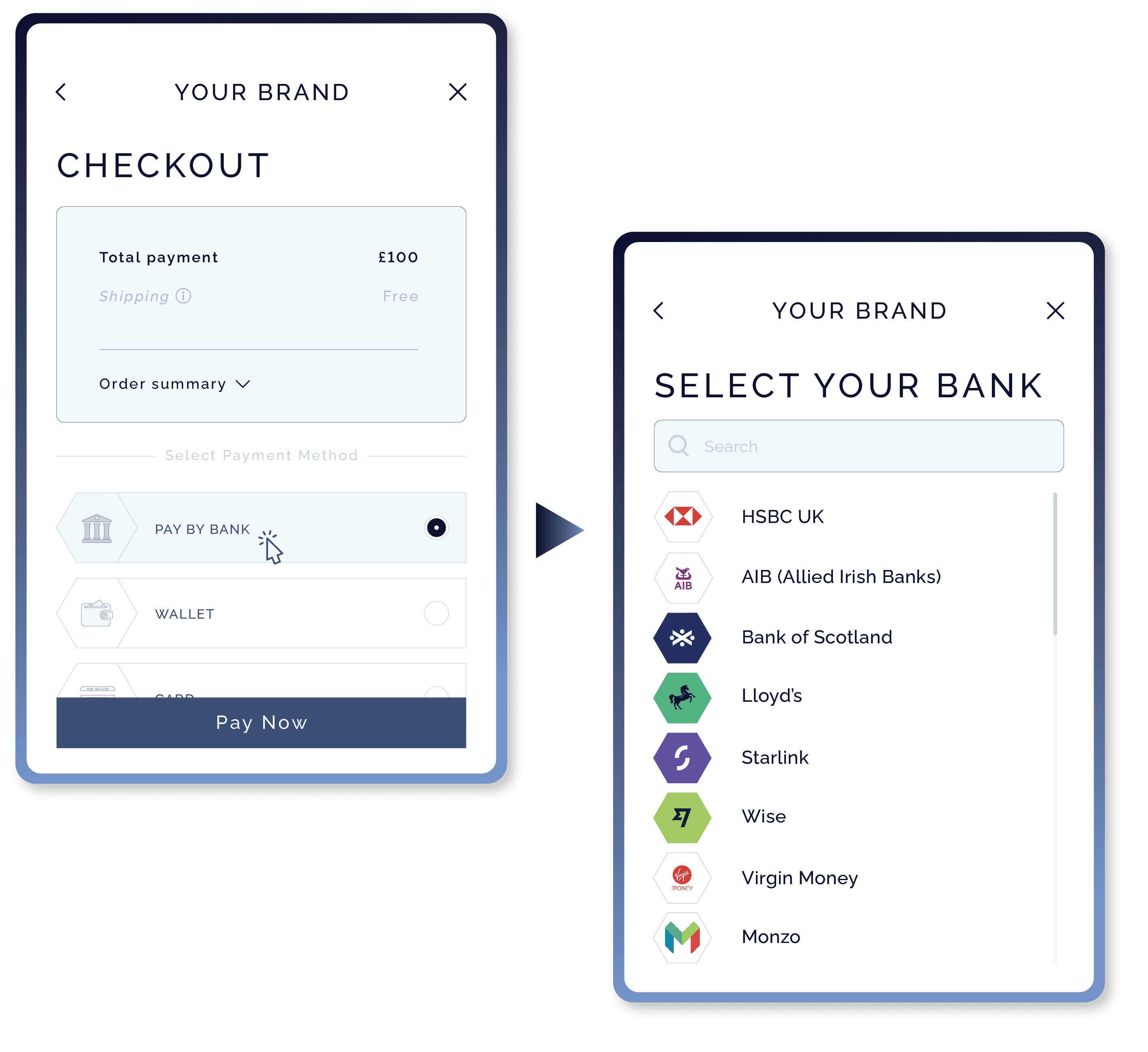

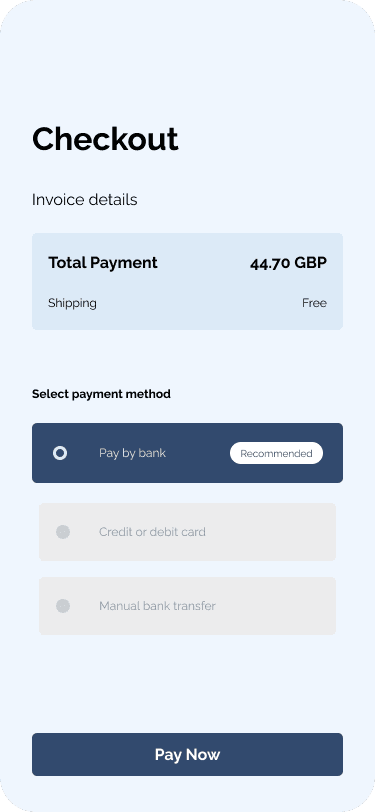

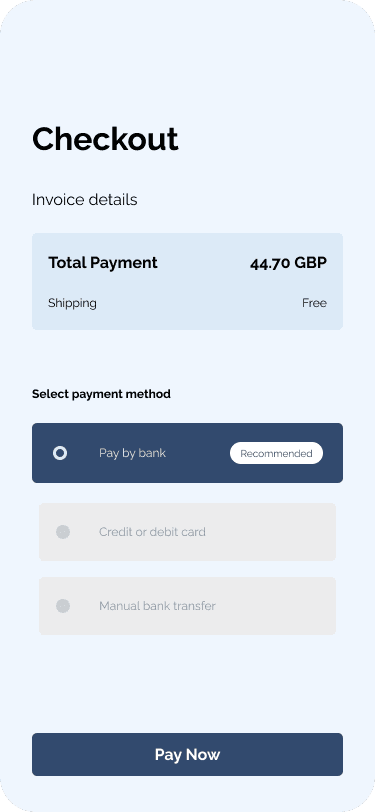

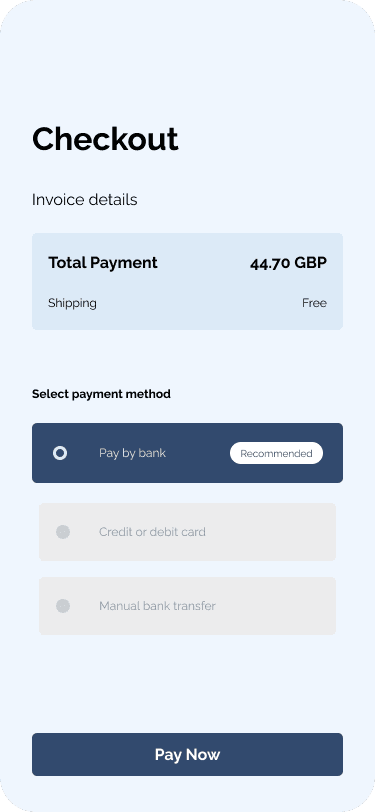

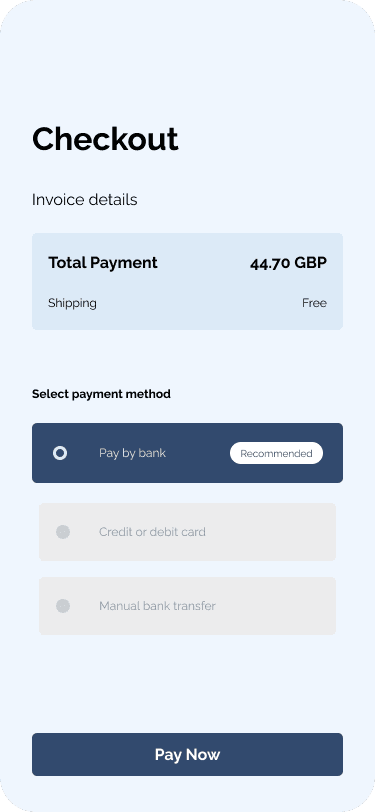

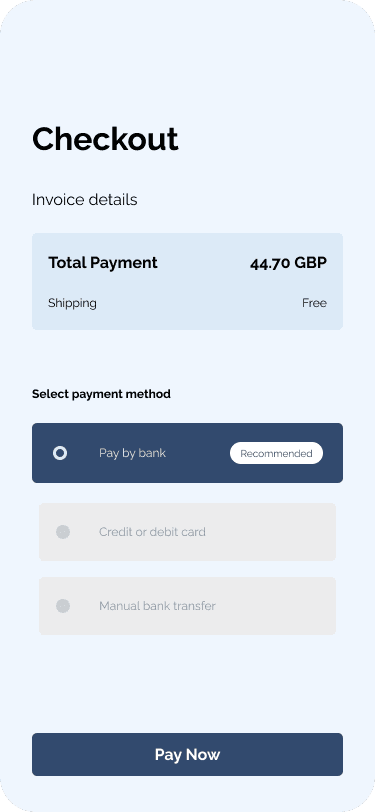

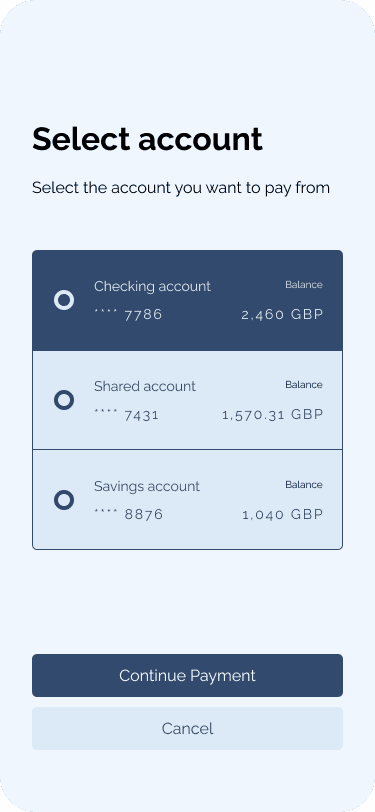

1

Step 1

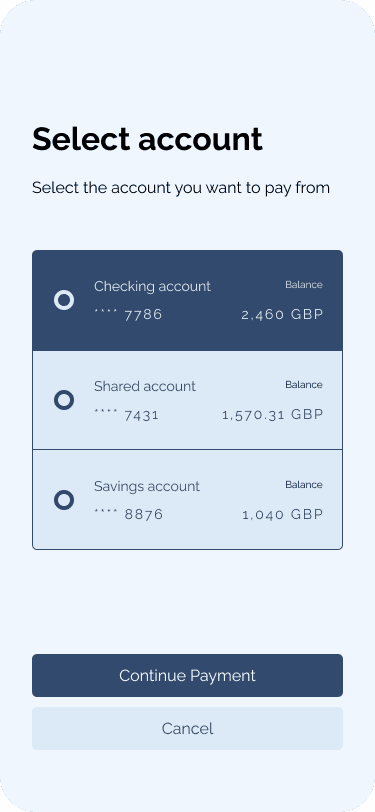

Customer chooses Pay By Bank at checkout.

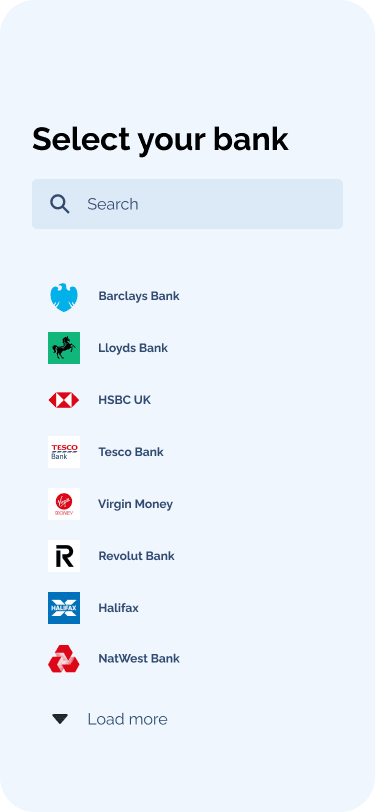

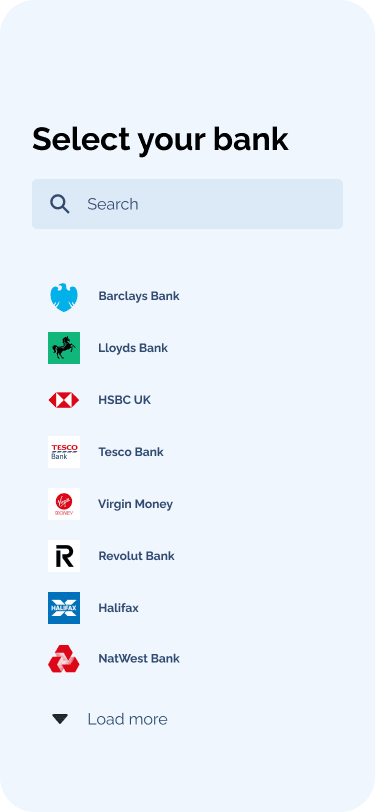

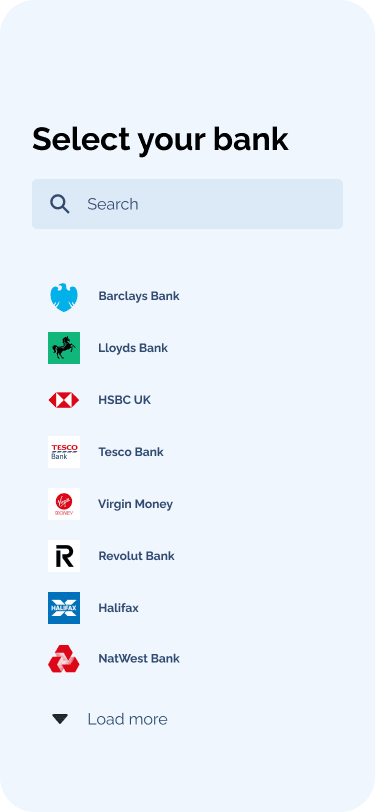

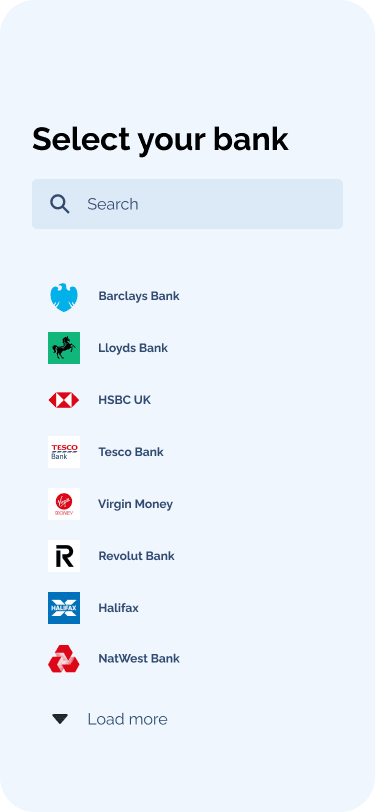

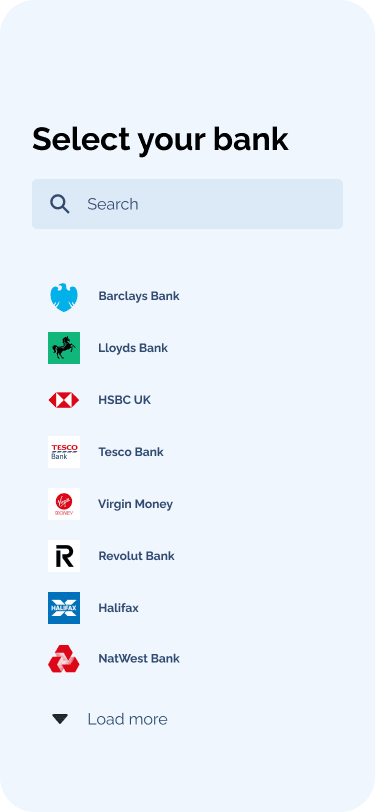

2

Step 2

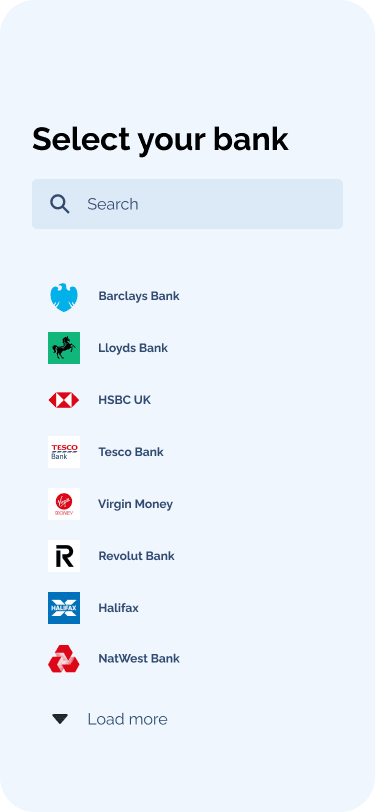

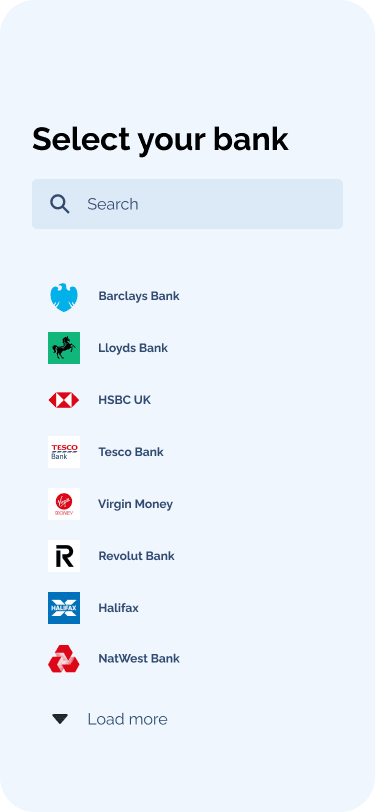

Picks their bank from familiar logos.

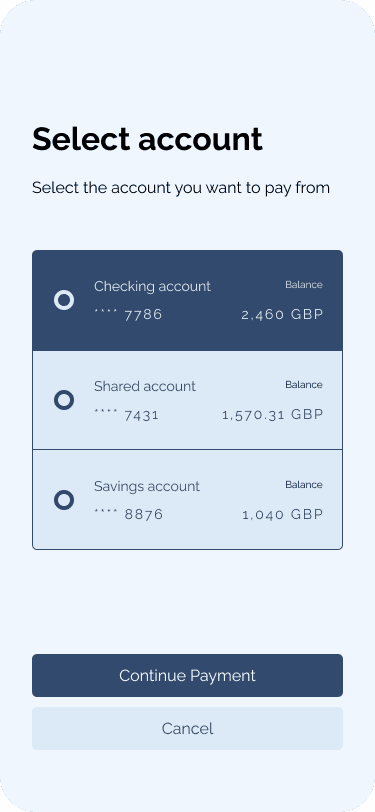

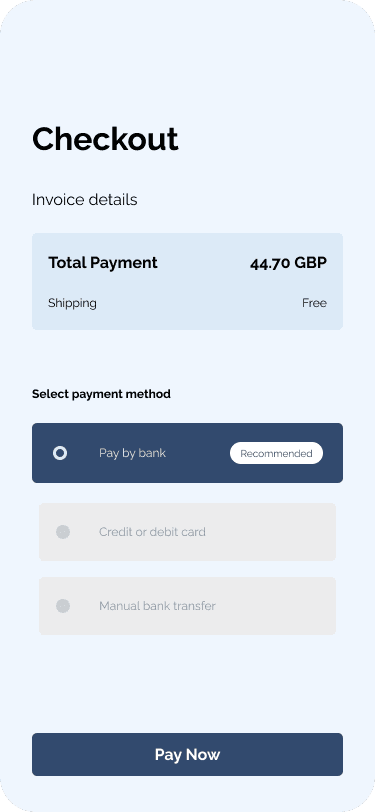

3

Step 3

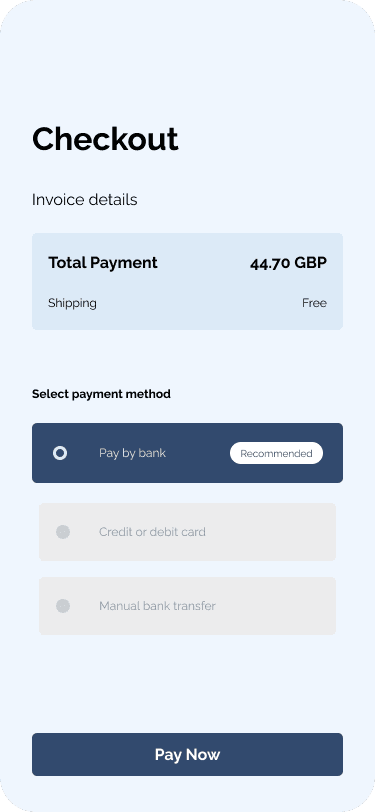

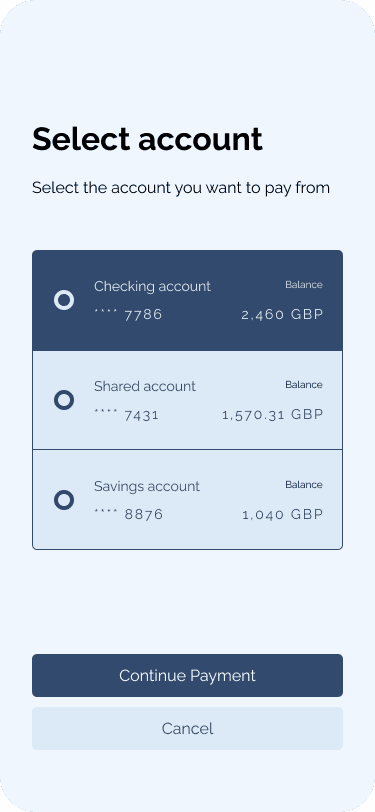

Chooses account to pay from.

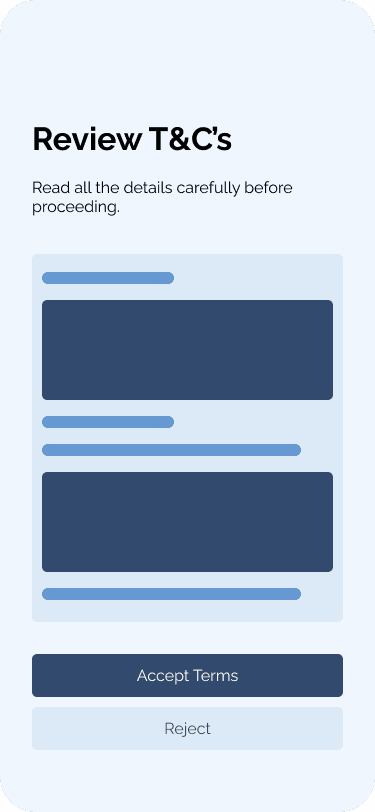

4

Step 4

Reviews and accepts terms.

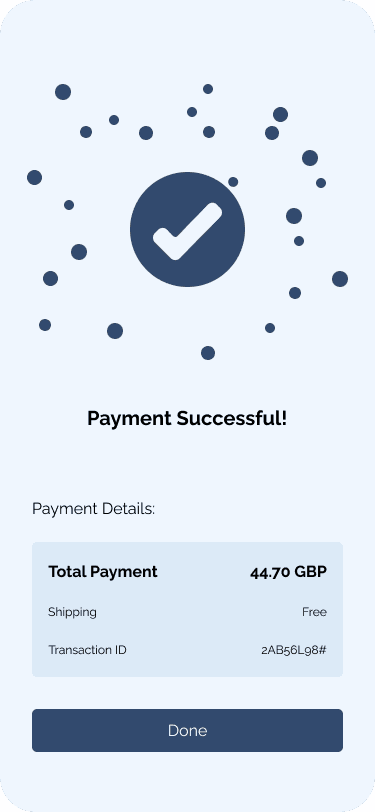

5

Step 5

Payment confirmed. You get notified instantly.

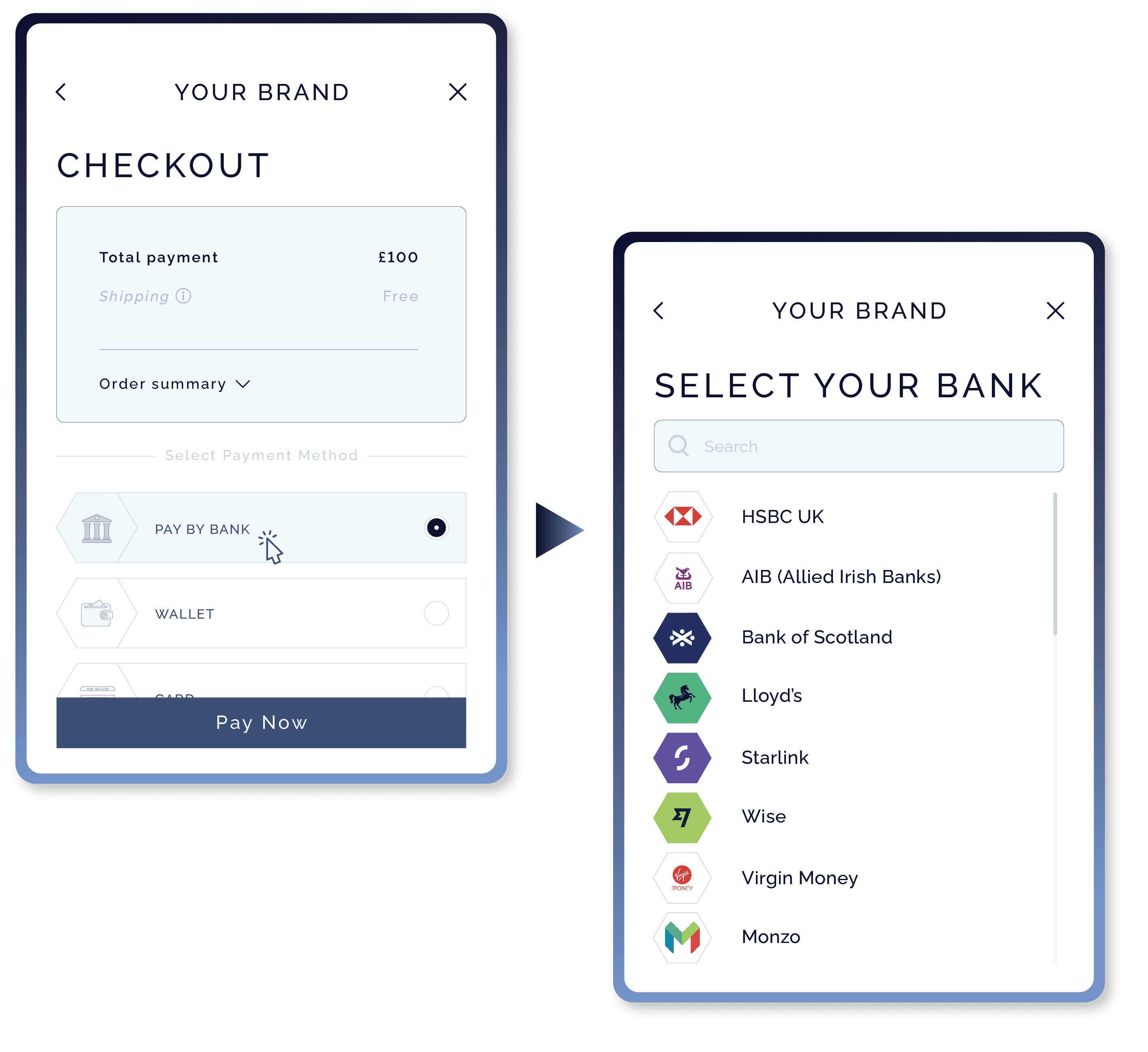

1

Step 1

Customer chooses Pay By Bank at checkout.

2

Step 2

Picks their bank from familiar logos.

3

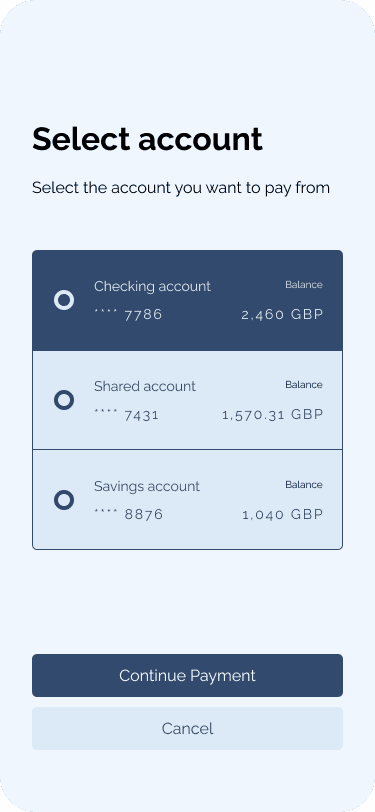

Step 3

Chooses account to pay from.

4

Step 4

Reviews and accepts terms.

5

Step 5

Payment confirmed. You get notified instantly.

1

Step 1

Customer chooses Pay By Bank at checkout.

2

Step 2

Picks their bank from familiar logos.

3

Step 3

Chooses account to pay from.

4

Step 4

Reviews and accepts terms.

5

Step 5

Payment confirmed. You get notified instantly.

Advantages of

Pay by Bank

Advantages of

Pay by Bank

Advantages of

Pay by Bank

Lower fees on large payments

Lower fees on large payments

Bank transfers cost less than cards for larger payments. Send links for invoices or deposits at reduced rates. More margin stays with your business.

Perfect for invoices and deposits

Pay by Bank

Pay by Bank

Send links for emailed statements, upfront bookings or instalments. Ideal for repeat customers or high-value one-offs. No phone keying or card details needed.

Instant confirmation in dashboard

Instant confirmation in dashboard

See authorised payments alongside card and online sales. Track status from request to settlement. One view matches everything to your records.

Connected to

everything else

Connected to

everything else

Connected to

everything else

Track bank payments

Bank payments show up with card sales in your dashboard.

Track bank payments

Bank payments show up with card sales in your dashboard.

Track bank payments

Bank payments show up with card sales in your dashboard.

Next-day payouts

Approved payments settle to your account the next day.

Next-day payouts

Approved payments settle to your account the next day.

Next-day payouts

Approved payments settle to your account the next day.

One login

Manage Pay by Bank alongside cards and online together.

One login

Manage Pay by Bank alongside cards and online together.

One login

Manage Pay by Bank alongside cards and online together.

Ready to save on payment costs?

Take bank payments via links for invoices, deposits or phone orders. Customers authorise direct from their app—no cards needed. Track status and payouts in your dashboard.

Ready to save on payment costs?

Take bank payments via links for invoices, deposits or phone orders. Customers authorise direct from their app—no cards needed. Track status and payouts in your dashboard.

Ready to save on payment costs?

Take bank payments via links for invoices, deposits or phone orders. Customers authorise direct from their app—no cards needed. Track status and payouts in your dashboard.